We all remember the Chicken Sandwich War that was ignited in 2019. The main aggressor was Popeyes which came out with a phenomenal chicken sandwich in August of 2019. Chick-fil-a answered in kind with their version of a chicken sandwich (equally as good) and took to social media to say that the battle was on! Things got crazy. Both companies were running out of chicken, bread, wrappers, due to the spike in demand for these products. Lines were out the door and some stores limited how many you could buy at a time. This was due to people buying them in mass and reselling them at a mark-up to people still waiting in line. Fights broke out at stores, Popeyes had to relaunch in the fall and things got really wild.

Wendy’s, McDonald’s and KFC were not going to be left in the cold during this craze. These outlets also poured fuel on their chicken sandwich marketing engine and entered the craze. I am not sure there was any one winner, but for us Dads that enjoy a good chicken sandwich, I would say our appetite was the big winner here.

Chicken Sandwich War Casualty

After the marketing war calmed down, we find ourself left with some great fast food chicken options available to the U.S. consumer. Outside of the hit taken by some of our waistlines, there was another casualty in this conflict.

Our pocket book was the true casualty in the Chicken Sandwich War. This cost burden stretches further than the fast-food chains, as we will explain in this post-mortem on the Chicken Sandwich War.

Meat Prices

As you can read in our article tracking Meat Prices in the US, grilling in general has gotten more expensive. Whether it is ground beef, steak, pork or chicken, we are all feeling the effects of inflation in the meat category. That said, the Chicken Sandwich War in conjunction with some other factors have chicken prices greatly outpacing it meat brethren in the inflation category.

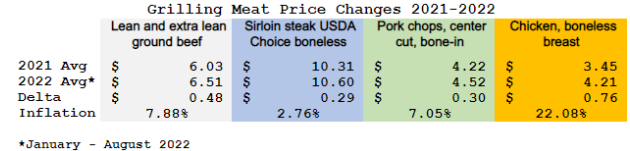

In a year-over-year basis, the price of boneless breast of chicken is up 22%. Compare this to ground beef or pork, which are natural substitutes, and they are only realizing 7-8% in inflation. Steak remains at premium pricing. Although costed much higher than the other grilling meats, steak is not up as significantly on a percentage basis at just under 3% (all pricing data from the USDA monthly updates).

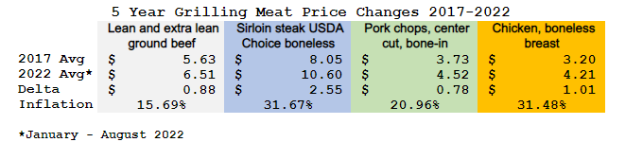

The 5-Year price change normalizes these numbers a bit. But again, chicken is among the leaders in price inflation with steak. Both meats have realized more than 31% increase in retail costs. Ground beef and pork prices are at 16% and 21% respectively in this 5-Year study. It is key to compare the 5-Year and the 1-Year increases, to highlight that much of the increase in the price of chicken has come in the past few years. The 1-Year inflation reading is 22% while the 5-Year is just an additional 10 points at nearly 32%. This is where the Chicken Sandwich War comes in!

Retail Price Drivers for Chicken Costs – Demand

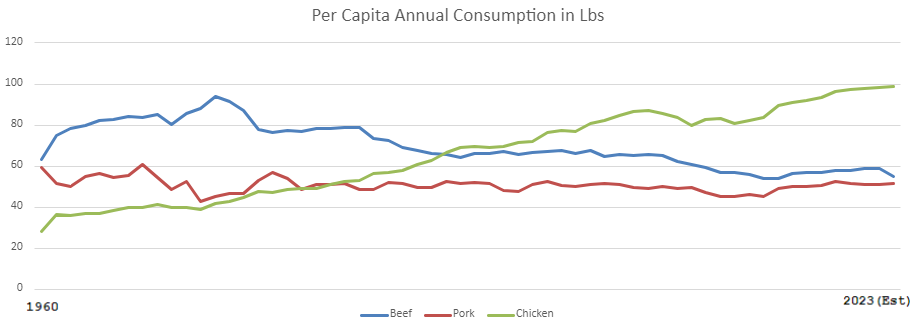

The Chicken Sandwich War have only bolstered an already growing US consumer demand for chicken. Chicken consumption in the US has been on a steady march upward since 1960. Much of this is driven by cost as it was historically the cheapest of the main grilling meats. The stigma of red meat has also helped drive demand for chicken, as it is felt to be the healthier of the meat options.

The National Chicken Council estimates that Americans will consume nearly 99 lbs of Chicken per capita in 2023. This is nearly double the amounts predicted for Beef (55 lbs) and Pork (51 lbs). That is a lot of chicken sandwiches! As demand grows, so will cost!

Retail Price Drivers for Chicken Costs – Shifting Demand

Not only is demand going up, but the Chicken Sandwich War along with Covid has created seismic shifts in demand of the type of chicken we are eating. As the Modern Dad Survival article about Meat Prices highlights, the demand has moved from “bucket” chicken to large chicken breasts used for restaurant chicken. Covid then reversed this for a period as restaurants closed and US consumers were back to primarily getting their chicken from grocery stores.

Bucket chicken used the entire chicken, while a disproportional demand of breast meat, puts great stress on only a portion of the chicken. Covid shifted this again, as the demand went to smaller birds, as larger birds that serviced the restaurant demand was put on hold for a period. All of these changes, have an industry in flux which has driven up costs as producers work to streamline their operations.

Retail Price Drivers for Chicken Costs – Fuel and Feed

Feed, fuel and fertilizer (the 3F’s) have all seen significant inflation over the past few years. Fuel and fertilizer costs have been driven by geopolitical events that have been felt across the world. This has driven up prices at the pump and stores for all items we are consuming.

Chicken feed is not immune to these pricing pressures as well. Feed uses both fertilizer and fuel as an input to its overall cost, hence why it would be up to producers. Fuel is also used by producers at their facilities and to get their products to market. Producers are working to recoup these costs and this is further adding to the price pressure we are seeing on chicken.

Chicken Sandwich War Casualty – The Rising Price of Chicken

Chicken prices have been going up, but are still very price competitive with Pork. The significant jump in chicken prices have been coming due to 60+ years of escalating demand. Demand increases and changes coupled with recent changes in some of the inputs to producing chickens (the 3Fs), have been a catalyst to the quick jump up in prices.

The Chicken Sandwich War certainly played a part in this. That said, the blame cannot go that far. Demand for chicken was already on the rise, and this shift in our desire for chicken breast from bucket chicken happened to occur just prior to Covid, creating chaos for producers.

At the end of the day, outside of being a small driver of the price inflation, the Chicken Sandwich War has really just benefitted the US consumer. We now have more delicious chicken sandwich options and it pushed Popeyes to do some philanthropic work to call a truce in the 2-year battle.

Chicken Sandwich War Truce

In the summer of 2021, Popeyes called a truce to the Chicken Sandwich War. They did this with another stroke of marketing genius by introducing a chicken nugget offering coated with the same batter as their chicken sandwich. The “We Come in Piece, 8 Piece” promotional campaign included a large donation by Popeyes to Second Harvest Foodbank (as detailed in this People article) as part of this truce offering. Popeyes did this by purchasing $1 Million worth of nuggets from their competition as part of this donation. This philanthropy bought them more goodwill with the public. Although the combatants in the Chicken Sandwich War may be at a truce, it has not tempered our craving for their sandwiches.

Fox Business suggests that Popeyes sales grew by 18.5% in 2019 compared to 8.9% the year prior. Remember that Popeyes did not roll out their chicken sandwich until August of that year and ran out for a period prior to relaunching in October. The Fox Article states that same store sales in the last quarter were up 34.4%. Incredible!!

In Conclusion

Find your favorite chicken sandwich. Try them all and drop us a line to let us know which is your preferred. If you are interested in other chicken options, try our Easy Chicken Fried Rice recipe as it will quickly become a family favorite.