If you are a new or an expecting Dad, college for your child may feel like a long way off. With a newborn you are looking at 18 years until this is a concern. Consider this a gift. Not only does this give you the peace of mind in not having to worry about your child going off to college soon, but you have also been given the investing gift of time. In a savings and investing sense time provides you with the benefit of compounding. Compounding is the effect of earning interest on an initial investment, plus interest on the interest of the initial investment, creating a snowball effect of investment growth over time.

I am not a financial planner so we will not be covering specific investment advise or detailed tax strategies in this article. But I am a Dad and I want to share with you some strategies that you can deploy to build a college savings plan to protect your child from coming out of school with boat loads of student dept.

What will College Cost?

To develop a plan, we must first determine what college will cost. Costs will vary significantly based on what type of school and program you desire. The following will weigh heavily on cost estimates for college:

-Public vs Private

-In-State vs Out-of-State

-Blend of 2-year/4-year vs solely 4-year

-Length of Major (standard 4-year degree or 5-year program to get CPA, Medical Prep, etc…)

EducationData.org has some great statistics on average college costs by type and state. According to their research the average cost of college in the U.S. is $35,720 (tuition plus additional expenses) per year and growing at an annual growth rate of 6.8%. Projecting this forward 18 years and assuming the same growth (inflation) rate of 6.8% this would mean college will cost $116,733 per year 18 years from now!! Scary right. If you use a more normal inflation rate of 2%, this is still $51,017 per year 18 years from now. Still a steep number if you think about 4 years of school ($204,068 for a 4-year degree 18 years from now).

You will have to decide for yourself, what number you are comfortable with. For purposes of this article, we are going to use $102,273, as our 4-year cost for college (18 years from now). Here is how we landed on this amount:

4-years In-State Tuition of $38,000 using 2021 figures

Inflation Rate of 2.0%

18-year time horizon

$54,273 in Total Tuition Cost

Adding roughly $12k/year in other costs and assuming the child will work at school or save prior to cover the difference.

$48,000 in Additional Costs

$54,273 + $48,000 = $102,273 is our College Savings Goal for this example

Understand, that this is probably not enough to cover the entire cost of a 4-year school 18 years from now, but in this model, the intent is for the child to cover some of this cost themselves to appreciate the investment being made in them. You will have to determine your own college savings goal for your child. Costs can be kept down through scholarships, attending a 2-year university prior to transferring to a 4-year university and by carrying college credits from high-school to college.

Strategies to Save for College

There are a lot of vehicles you can use to build a college savings fund (Roth IRA, CDs, 529 Plan, etc.) State 529 plans are one of the more common ways and have some tax advantages that you should consider when doing your research. If you select a 529 plan, consider setting it up directly with your state, rather than through a broker where you would be subject to fees. This article from Nerd Wallet provides some pros and cons of various investment vehicles and ensure you do some research to determine what plan is right for your situations.

For purposes of this article, we are going to assume you are using an investing vehicle that allows you to generate a 6% investment return, which is well below the ten year historic average of 9+% as detailed by Goldman Sachs. CD’s or Bank Savings accounts are not going to garner 6% return at this time, so know that the below plans assume you are investing using a vehicle that will allow you to invest in mutual funds, ETFs, or other investments that could yield 6% over a long time horizon (18 years in this case).

3 College Savings Methods

The following 3 strategies will present paths to $102,273 in College Savings and know that different combinations of these strategies can be used to get you there. The key is in coming up with a plan and doing your best to stick to it.

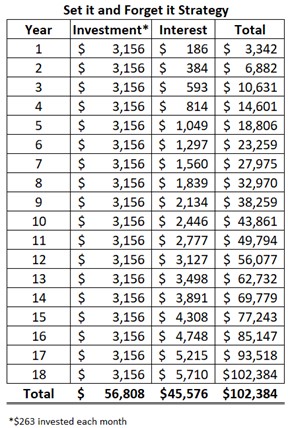

- Set It and Forget It – This path takes a budgeted approach of setting aside a set amount each month to go direct into your college savings plan for your child. The easiest way to get this done is by having it come out as a direct deposit from your paycheck to your selected investment vehicle. And hence, the “set it and forget it” process takes place.

To achieve $102k over 18 years (assuming a 6% annual return) you will need to invest $263 each month into the plan. The chart below shows how this will compound over the years and your total investment using this plan of $56,808.

Pros: Once you build this into your budget and setup the direct deposit, you will not even realize this is happening each month

Cons: This is a commitment for all 18 years and their may be periods over that time where money gets tight.

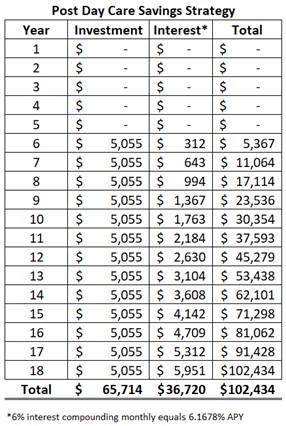

- Post Daycare Savings Strategy – If you have read our article “Kids Cost How Much!?!”, you may remember that childcare can cost more than $13,000 a year. This is a huge expenditure that may fully go away when your kid starts kindergarten (you may have to spend for aftercare or summer costs, but the bulk of the expense will be covered by free education – thank a tax payer!). Rather than give yourself a $13k a year raise, why not take about half of this amount and sock it away in a college fund for your child.

This plan starts in year 6 of the child’s life (when they start kindergarten) and goes on for the next 13 years at the tune of $5,055 each year. The strategy assume you make the investment at the beginning of each year, but remember that we used a fairly conservative return rate of 6%, so if you wanted to spread this out to monthly amounts that should still get the job done. The total cash outlay of this plan is $65,714.

Pros: This should not be felt in the pocketbook as it coincides with a big cost reduction of childcare.

Cons: This plan requires the largest cash outlay of all of our plans due to the shorter time horizon used (13 years) to reach our goal.

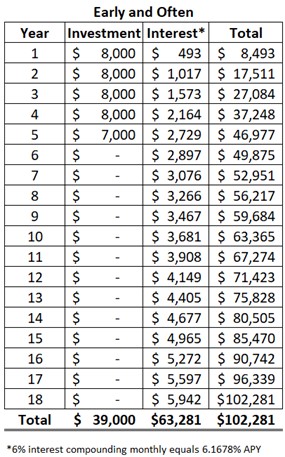

- Early and Often Plan – This strategy makes great use of the 18 year time horizon that you are working with. The plan looks for big investments early in the child’s life (while they are still cute) and then ends it when it is at an amount that should compound to reach our goal. It requires great capital outlay upfront but consider leaning on family or friends that are eager to get that child a first birthday gift!

We used $8,000 investment per year for the first 4 years of the plan and then $7,000 in year 5 (as we did not need the full $8,000 to reach the goal). $8,000 was selected as it is the maximum allowed per child to achieve the tax benefit in the state we live in (for a 529), but your state and rules may be different, so make sure to check them out. This plan assumes some significant disposable income available to you early in your child’s life ($8,000/year) to achieve this goal. If you don’t have this amount, you can play with some compounding calculators to see what you would need to do to reach your goal.

Pros: Due to using large lump sums at the beginning of this plan, this has the lowest cash outlay of any of the strategies at $39,000.

Cons: This plan requires a lot of disposable income to have this level of investment available while also taking on the other costs associated with a newborn.

In conclusion, there are a lot of different ways to think about college savings. The strategies presented here can be blended to a model that meets your needs to achieve your desired goal. Take advantage of the time horizon that you have for your child and use compounding to minimize the “out of pocket” expense you are paying. This will be one of the biggest expenses of you and your child’s life, so take the time and do the research to know what strategy will work best for you!