You’re here, so I assume you have been searching online as to the cost of having a child. I wish I took that initiative when I was in your shoes. There are a lot of factors to consider and costs can add up quickly. Results vary wildly on this topic based on the lens used for the study and the demographics of the parents considered (including country, region and income level).

To provide useful information on this subject, we are going to be very prescriptive with the methodology used to develop our results. We reference where we pulled the data and what categories were covered and which were not. If money is not an object, there are many modern conveniences that can be used to make baby life more comfortable. Things like baby carriers, swings, high tech strollers, sound machines, bathtubs, a larger vehicle to accommodate a growing family and even upgrading to a larger home to get more room if necessary. This article assumes that you are forgoing some of these high-end luxuries, or even better yet, we can assume you will accumulate some of these items as gifts from friends and families and hence not add this cost to the study.

Baby Shower Diversion

While we are at this point lets divert to the benefits of the Baby Shower. If your baby has not arrived yet, you really need to talk up the value of the Baby Shower. Your wife will likely be shocked by your interest in the subject, but no need to reveal your motives. Even consider suggesting a Couples Baby Shower, because you not only rack up some good gifts and save you money, but this may also be one of the last time you will get to hang with some of your buddies for a bit. At the same time, be thoughtful in encouraging your partner’s friends and family in throwing her a shower (or multiple) to help get you some of these items. But we digress… Back to the monthly cost for a new child .

Monthly Cost for a New Child

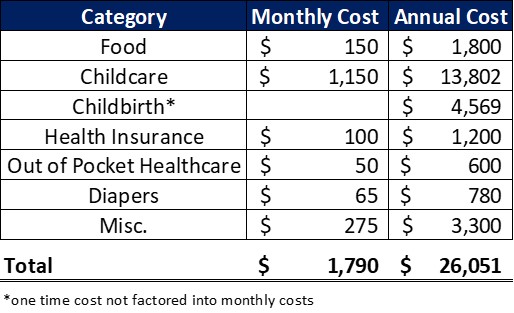

In this study we are going to focus on the essentials. What costs will you incur to feed, clothe, protect, and give your baby enrichment in the first year of their life. This study will assume that you are not upgrading your transportation, home or making other luxury purchases out of your pocket (revisit The Baby Shower Diversion if necessary). However, we will provide costs relative to normal items needed to care for an infant (see the Miscellaneous category).

Food

Food can be a very tricky cost to estimate, as a successful nursing mother can greatly reduce this cost. However, nursing is not always an option for many reasons (adoption, milk production, baby acceptance, etc…). Food is also tricky as the cost of formula can vary greatly based on the needs of the baby. Some babies require more specialized formulas as they are developing, which comes with a more specialized price tag. To simplify this, we leaned on the United States Government. The USDA publishes a Food Plan monthly that breaks down food consumption costs based on age and puts it into four levels: Thrifty Plan, Low-cost Plan, Moderate-cost Plan and Liberal Plan (USDA Food Plans: Cost of Food Report from February 2021). The monthly cost for a 1-year old ranges from $98.70 (Thrifty Plan) to $183.30 (Liberal Plan). The USDA report assumes meals are eaten in the house and follow the 2005 Dietary Guidelines for Americans. The Moderate-cost Plan comes in at $150.60, so for simple math we used $150 in monthly food consumption for a baby.

Childcare

Be kind to your parents and extended family. If they can pitch in for a day or two a week, they can save you a bundle on childcare. There is also a great childcare cost benefit to jobs that have seasonal breaks like teaching, tourism/hospitality, and some retail jobs. If you have extended seasonal breaks that can get one or both parents at home to care for the child during the off season, you will save on the biggest expense associated with infants. This is important to consider when looking at childcare options, as some daycares do not allow for unpaid seasonal breaks with assurance that you will be able to regain your child’s spot upon return.

We are breaking this study down to a monthly cost, but in the first year of your child’s life, you may not incur any childcare cost for a time if you are able to exercise a parental leave plan (12 weeks or more depending on area and employer). See our article on Reducing Childcare Costs for some strategies on how to save.

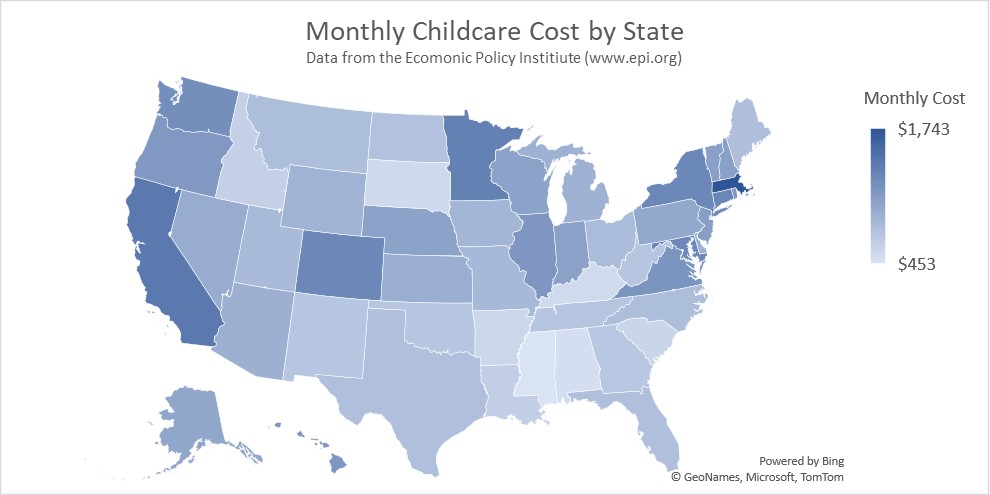

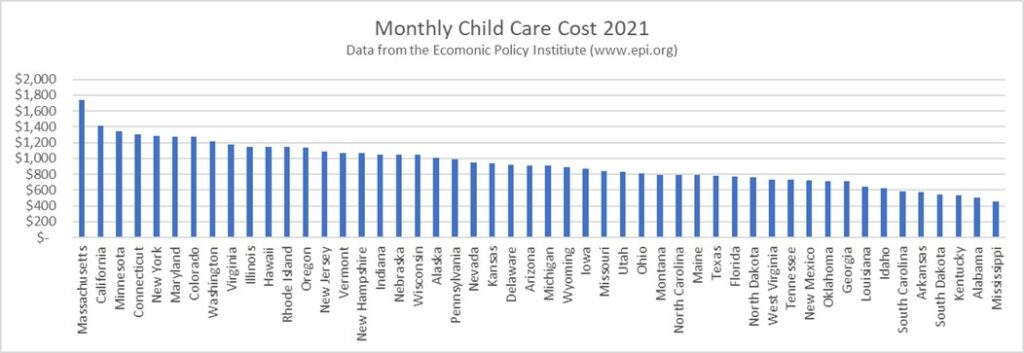

For this study we utilized an average monthly cost of full time childcare for a baby or infant. We pulled this information from the Economic Policy Institute’s website that provides childcare costs by state. We used Illinois as our data point to represent childcare costs ($1,150 per month). But as the below graphics show, costs vary greatly by location.

Heath Care: Childbirth, Insurance Premiums and Out of Pocket

It seems to be a reoccurring theme here that these costs can run a wide range. Out of pocket expenses are predicated on your insurance plan and child’s health care needs at an early age. If you are in a country that subsidizes healthcare (and you use the subsidized plan), then this can be zero. Looking at this for the average Baby (0-12 months) in the United States and the annual expenditures are just under $12,000 (2017 study by JAMA Pediatrics). This number is not out of pocket though, so a little more analysis is needed to break this down.

$4,569 is the current average out of pocket costs for childbirth and that should eat up much of your premium in the first year of your child’s life (cost is from the journal of Health Affairs Vol 39, no. 1). You can expect to see your health insurance cost go up $100 a month to cover an addition to the family and then an additional $50 a month in co-pays and other costs that may not be covered by your insurance. All costs were based on a relatively healthy baby and assuming insurance is covering most costs after deductible. Note that there are some insurance plans that are very low cost in adding a new child. If you and your partner are on separate plans, consider examining all options to understand your best cost and coverage available for your growing family. If you do not have an existing plan option and do not qualify for Medicaid, you can look into The Children’s Health Insurance Program (CHIP) as an option to consider. It is relatively low cost, but you must qualify to enroll.

Childbirth Cost: $4,569 Out of Pocket (one Time)

Health Insurance: $100/Month

Misc. Co-Pays/Other: $50/Month

Diapers

This category is a little more cut-and-dry (no pun intended). The average baby uses 8-10 diapers per day in their first year of life and the average diaper cost is 25 cents (if bought in bulk), putting this at a daily cost of $2.00-$2.50, so we will assume a monthly cost of $65. Now this can be reduced if one decides to use cloth diapers. If you go the cloth diaper route, your new diaper cost will be less than a years’ worth of disposable diapers.

There is the potential to offset the cost of 3,000 annual diapers by cutting your coffee shop trips. That said, you will need the caffeine, so if this is one of your life’s little pleasures you may look other places to offset that diaper cost. See our Diaper Changing guide for Dads!

Misc.

This category covers things like clothes, toys, crib, strollers, baby monitors, cameras, wipes, sound machines and many other miscellaneous items you may pick up during your child’s young life. This area is where costs can get really out of whack if you decide to splurge on luxury items or if you decide to pickup every gadget a new parent could desire. As stated earlier, we are assuming some of this came to you as shower gifts and that you are a responsible buyer when spending out of pocket. There are certainly essential costs in this category (car seat, stroller, clothes, crib, etc…), so we would be remiss if we left this blank. We will ballpark an additional $275 per month in this category as a crib ($200 – $500), car seat ($60 – $250) and stroller ($150 – $400) can quickly eat into this amount if you are buying out of pocket (see earlier shower comments).

Wipes serve as a funny example to costs you may not have planned for. As noted earlier, you are going to go through 3,000 diapers in year 1. If you assume 3.5 wipes per diaper (that may be an understatement), then you are looking at 10,500 wipes in year 1 for diapers alone. You will find you are also using wipes for other things (food, spills, general sanitation, etc…). This being the case, it is safe to assume 11,000 wipes will be used in the first 12 months of a child’s life. At a cost of 4 cents per wipe, you are facing $440 in annual baby wipes costs in year 1.

Budget

Add this all up and you are looking at an additional $1,790 in monthly costs for a new child. Depending on the lifestyle you were living prior to the new addition, you may have some costs that go away (bar, softball league, golf outings, multiple guys weekends, etc.). Since reusing wipes is not a great option, please see our article on budgeting to realize how you can setup a plan for your new costs and also factor in some of the fun that you have been used to having.